As the backbone of many economies, SMEs play a vital role in job creation and economic growth. However, SMEs are often more vulnerable to economic changes than larger businesses. Several economic changes can trigger SMEs to close or liquidate, and it is important to understand these triggers to protect and support these essential businesses.

One of the most common economic changes that can negatively impact SMEs is an economic recession or a simple slump in economy as witnessed in recent years. Although the UK is on course to narrowly avoid a recession in 2023, the principles still apply in the current climate. Decline in consumer demand for goods and services may be evidential, leading to decreased revenue for SMEs. This can result in a lack of cash flow, making it difficult for businesses to pay bills and continue operating.

We examine that state of business insolvency in the UK, the reasons this is happening, and how to protect your business from insolvency taking over…

What Is The Current State Of Insolvency In The UK?

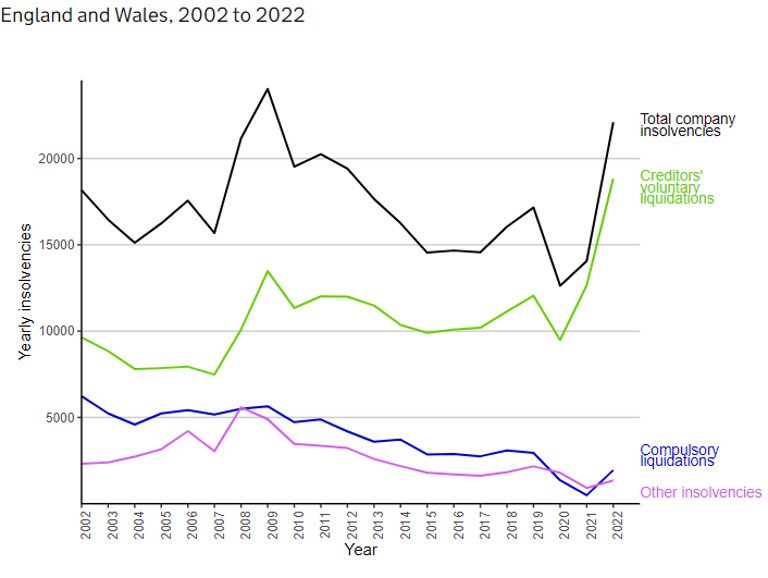

According to the Insolvency Service and Companies House, the number of UK business insolvencies increased by 23% during the 2008 financial crisis compared to the previous year. Similarly, during the 2020 COVID-19 pandemic, the number of UK business insolvencies increased significantly whilst the total number of company insolvencies registered in 2022 was 22,109, as shown below. This was the highest number since 2009.

Many people point to the obvious reasons of business insolvencies, such as the current economic climate. However the reasons are far more embedded and in-depth than this. What are the primary factors that affect the wellbeing of a company? Let’s examine some of the commonly observed components…

Interest rates

Economic change that can impact SMEs is an increase in interest rates. When interest rates increase, it becomes more expensive for SMEs to borrow money, which can lead to a decrease in investment and expansion. In some cases, SMEs may struggle to pay back their loans, which can further impact their ability to operate.

Changes in government policies

Changes in government regulations can also significantly impact SMEs. New regulations may require businesses to make expensive changes to their operations or may limit their ability to operate in certain areas. This, in turn, will lead to a decrease in revenue.

Increase in competition

Increased competition is also a significant threat to SMEs. As new businesses enter the market, SMEs may face increased competition, which can lead to a downturn in revenue. Additionally, established businesses may be forced to lower prices to remain competitive, which can negatively impact profit margins.

Changes in consumer behaviour

Changes in consumer behaviour can also negatively impact SMEs. For example, consumers overall prefer online shopping over in-person shopping, which has led to brick-and-mortar stores and the high street seeing a decrease in revenue.

Finally, technological advancements can also present challenges for SMEs. New technologies may require significant investments, and failure to adopt them may make businesses less competitive.

How Do I Protect My Business From Insolvency?

So, where does it leave small owner-run businesses? Overall, it is crucial to recognise the challenges that SMEs face in a constantly changing economic.

Small owner-run businesses may also struggle to adapt to changing consumer behaviour during an economic downturn. For example, if consumers are more hesitant to spend money during tough economic times, small businesses may need to find ways to entice customers to continue purchasing their products or services. This can require significant investment in marketing and advertising, which may not be feasible for small businesses with limited resources.

Despite these challenges, small owner-run businesses can still survive and even thrive during a changes in economy. One strategy is to focus on providing excellent customer service and building relationships with customers. By developing a loyal customer base, small businesses can ensure a steady stream of revenue even during tough economic times.

Small businesses can also look for ways to cut costs and improve efficiency. This may involve renegotiating contracts with suppliers or finding ways to streamline operations to reduce expenses.

Finally, small businesses can seek out support and resources to help them navigate a recession. This may include accessing financing programs or working with business advisors, like ourselves, to develop a plan for weathering the storm. A business advisor can provide a much-needed safety net and offer guidance to help the business regain its footing during tough times, starting with something as simple as cash flow forecasting.

Cash flow forecasting is often found to be very beneficial for struggling businesses because it helps to:

- Identify potential cash shortfalls early, allowing corrective action to be taken.

- Make better-informed decisions about investments, expenditures, and financing.

- Build trust and confidence with creditors through transparency.

- Improve operational efficiency by identifying areas of inefficiency, consider technological advancement.

- Support long-term planning by anticipating future cash flows and being proactive.

Decline in business can be a challenging for small owner-run businesses, no matter what the cause is. However, with a focus on customer service, cost-cutting, and seeking out support and resources, small businesses can survive and even thrive during tough economic times.

We hope this has outlined to you the state of insolvency and how to protect your business against it. If you’d like to know any further information on anything mentioned, or anything accounting related for that matter, please do not hesitate to get in contact with us at Nordens, where one of our trusted advisors would be happy talking you through your query.