Keyword: Personal Tax Planning

-

Nordens Named Finalist in Two Categories at the 2025 Accounting Exce...

16 July 2025Recognised for Outstanding Service and Bold Campaigning This year’s awards received a record number of entries from across the UK, showcasing some of the most […]

-

Webinar: Money Management for Neurodivergent Business Owners

3 June 2025Join our expert panel for an online webinar where they’ll be discussing their top tips for neurodivergent business owners.

-

Cryptocurrency & Tax: What You NEED to Understand

28 May 2025Cryptocurrency investments have grown significantly in recent years, with about 6% of the UK population reportedly owning digital assets such as Bitcoin, Ethereum, Tether, and Dogecoin.

Given the potential for significant financial gains—and losses—it’s no surprise that HMRC has taken a keen interest. Estimates suggest that up to 95% of cryptocurrency holders could be non-compliant with tax regulations, putting many at risk of facing penalties if their activities are scrutinised.

-

Tax Planning, Simplified: What You Need To Know

16 May 2025Effective year-end tax planning not only ensures you’re compliant with tax laws but also positions you to take full advantage of the tax benefits available…

-

ADHD-Friendly Money Management Tips for Business Owners

8 May 2025We offer some expert neurologist-friendly advice for business owners with ADHD on how to master their money management.

-

Making Tax Digital: Is It Time To Act?

2 May 2025We provide a helpful update of what you need to know about Making Tax Digital in 2025 as a business owner.

-

The Ultimate Tax Guide for Social Media Influencers

10 April 2025Becoming an Influencer can be a lucritive career move but it brings with it a range of tax related challenges. Fear not, our team are here!

-

Personal Tax vs Corporation Tax: Plain and Simple

1 April 2025We provide a plain and simple explaination of the differences between Personal taxes and Corporation tax for you and your business.

-

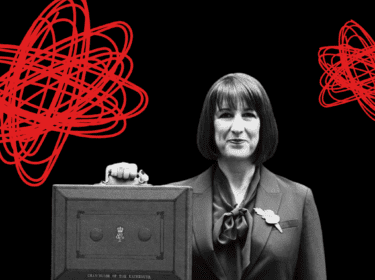

Spring Budget 2025 – What Changed?

28 March 2025On 26th March, the Chancellor, Rachel Reeves, delivered her first Spring Budget amid weak growth forecasts and rising borrowing costs- but for businesses, the headline […]