Keyword: Tax

-

Making Tax Digital for Income Tax Webinar | Nordens

3 February 2026Making Tax Digital for Income Tax is often described as another business burden. It isn’t. For many business owners and landlords, MTD for Income Tax […]

-

Capital allowances after Budget 2025: key planning considerations

14 January 2026Capital allowances play an important role in how businesses recover the cost of investing in plant, machinery, and other qualifying assets. They directly affect taxable […]

-

VAT on Selling a Business Car: What You Need to Know

8 January 2026Selling a car that has been used in your business often raises a simple question with a not so simple answer. Do you need to […]

-

Image rights tax changes from April 2027: what athletes and clubs ne...

19 December 2025The Autumn Budget delivered many headline announcements, yet one of the most significant changes for the sports industry was tucked away in the tax administration […]

-

Autumn Budget 2025: Impact On SMEs

26 November 2025The second Autumn Budget delivered by a Labour government in over a decade has landed, and Chancellor Rachel Reeves says it involves “fair and necessary” […]

-

National Minimum & Living Wage 2026 – What SMEs Need to Know

26 November 2025Find out about the increases to the National Minimum Wage following the Autumn Budget and what this means for businesses in the UK.

-

The Countdown to MTD ITSA: Are You Ready for April 2026?

28 October 2025The next stage of Making Tax Digital (MTD) is finally coming into effect… and this time, it’s official. From April 2026, the way many individuals report their income […]

-

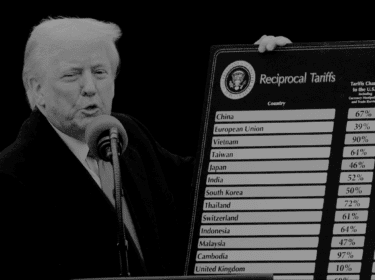

Trump’s 2025 Tariffs Explained: What It Means for UK Businesses

21 October 2025The return of Donald Trump to the White House has reignited global trade tensions, as his administration pushes forward a renewed wave of tariffs on […]

-

Making Tax Digital (MTD) for Income Tax: What You Need to Know

9 October 2025The government’s Making Tax Digital (MTD) initiative continues to reshape how businesses manage and report their finances. From April 2026, MTD for Income Tax will begin rolling out, […]