News & Insights

-

Why Setting Business Goals For 2025 Is So Important

10 January 2025We take a look at why setting the right kind of goals is so important for business owners, and how SMART can help.

-

The Benefits Of Cloud Accounting

9 January 2025Cloud accounting has revolutionised how businesses manage their finances. By leveraging the power of cloud-based platforms like Xero and QuickBooks, companies can simplify bookkeeping, streamline […]

-

Divorce Day: Essential Tax Tips For Separating Couples

8 January 2025January 8, often referred to as “Divorce Day,” marks a significant spike in couples initiating divorce proceedings after the holidays. But what does divorce mean when it comes to tax?

-

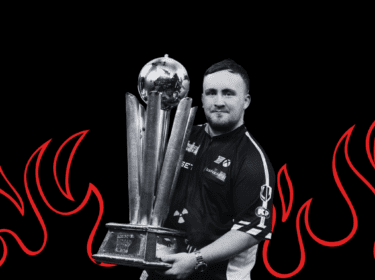

How Target Darts Are Revolutionising the Game

6 January 2025In the competitive world of sport, few have managed to shake the foundation and command attention quite like Target Darts. We speak to Target’s MD James Tattersall about what they’re doing differently.

-

5 Ways To Increase Your Success In 2025

1 January 2025We break down the five ways to increase your chances of success in goal-setting and how Nordens can help provide the assistance to smash your targets….

-

Your Business Calendar – The Crucial Dates for 2025

23 December 2024Here’s a breakdown of the crucial financial and tax dates for your business in 2025, in a way that you can actually understand.

-

Nordens End of Year Awards 2024

19 December 2024Find out who the big winners were from our 2024 end of year awards ceremony, from “Diva of the Year” to the “Walking Encyclopaedia”…

-

A Guide To Investing In Stocks From A Wealth Manager

17 December 2024We spoke to one of our financial partners, Elliott Winner of KWM Wealth Ltd., about the rise of stock investment.

-

Bitcoin Breaks $100k: A Historic Moment For Crypto

16 December 2024Our partners, ICONOMI look at why Bitcoin breaking the $100k barrier is something that investors should be paying attention to.