Category: Highlight

-

Autumn Budget 2025: Impact On SMEs

26 November 2025The second Autumn Budget delivered by a Labour government in over a decade has landed, and Chancellor Rachel Reeves says it involves “fair and necessary” […]

-

National Minimum & Living Wage 2026 – What SMEs Need to Know

26 November 2025Find out about the increases to the National Minimum Wage following the Autumn Budget and what this means for businesses in the UK.

-

Companies House ID Verification 2025: ACTION NEEDED

3 November 2025The UK is about to see its most significant reform to company law in almost 200 years. The Economic Crime and Corporate Transparency Act (2023) […]

-

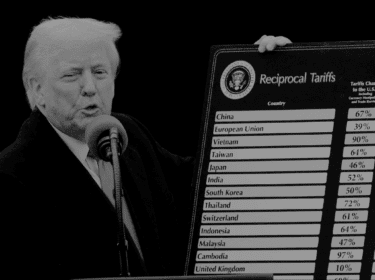

Trump’s 2025 Tariffs Explained: What It Means for UK Businesses

21 October 2025The return of Donald Trump to the White House has reignited global trade tensions, as his administration pushes forward a renewed wave of tariffs on […]

-

Making Tax Digital (MTD) for Income Tax: What You Need to Know

9 October 2025The government’s Making Tax Digital (MTD) initiative continues to reshape how businesses manage and report their finances. From April 2026, MTD for Income Tax will begin rolling out, […]

-

ADHD Awareness Month: Challenges, Strengths and Financial Strategies...

7 October 2025October marks ADHD Awareness Month, a time to recognise both the challenges and the strengths that neurodiverse individuals bring to the business world. For many entrepreneurs […]

-

Cryptocurrency & Tax: What You NEED to Understand

28 May 2025Cryptocurrency investments have grown significantly in recent years, with about 6% of the UK population reportedly owning digital assets such as Bitcoin, Ethereum, Tether, and Dogecoin.

Given the potential for significant financial gains—and losses—it’s no surprise that HMRC has taken a keen interest. Estimates suggest that up to 95% of cryptocurrency holders could be non-compliant with tax regulations, putting many at risk of facing penalties if their activities are scrutinised.

-

Thinking Of Selling Your Business? Here’s What’s Needed

21 May 2025We explain five things you can do to maximise your business’s value and increase your chances of selling your business.

-

Tax Planning, Simplified: What You Need To Know

16 May 2025Effective year-end tax planning not only ensures you’re compliant with tax laws but also positions you to take full advantage of the tax benefits available…