News & Insights

-

Overdrawn Directors’ Loans: Explained

6 May 2025Directors of limited companies often take money out of their business in different ways, through salaries, dividends, or loans. While Directors’ Loan Accounts (DLA) can […]

-

Making Tax Digital: Is It Time To Act?

2 May 2025We provide a helpful update of what you need to know about Making Tax Digital in 2025 as a business owner.

-

The Ultimate Tax Guide for Social Media Influencers

10 April 2025Becoming an Influencer can be a lucritive career move but it brings with it a range of tax related challenges. Fear not, our team are here!

-

Trump’s Tariffs: The Impact On UK SMEs

3 April 2025US President, Donald Trump has announced a range of sweeping tariffs that impact businesses in the UK. We look at what this means for SMEs.

-

Personal Tax vs Corporation Tax: Plain and Simple

1 April 2025We provide a plain and simple explaination of the differences between Personal taxes and Corporation tax for you and your business.

-

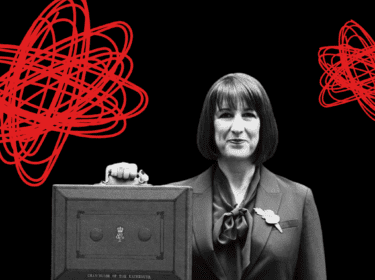

Spring Budget 2025 – What Changed?

28 March 2025On 26th March, the Chancellor, Rachel Reeves, delivered her first Spring Budget amid weak growth forecasts and rising borrowing costs- but for businesses, the headline […]

-

ATED Update – Everything You Need to Know In 2025

18 March 2025With the ATED filing deadline fast approaching on 30th April, here are some top tips from one of our tax specialists, Raj Bassi.

-

Neurodiversity Celebration Week – How We’re Supporting

17 March 2025We look at what we do for Neurodiverse Business Owners and how can help them navigate accounting challenges

-

Audit Changes: What Business Owners Need to Know

14 March 2025From April 2025 there will be changes to Audit regulations in the UK. We provide a helpful and insightful overview for business owners.