Keyword: Tax

-

Thinking Of Selling Your Business? Here’s What’s Needed

21 May 2025We explain five things you can do to maximise your business’s value and increase your chances of selling your business.

-

Tax Planning, Simplified: What You Need To Know

16 May 2025Effective year-end tax planning not only ensures you’re compliant with tax laws but also positions you to take full advantage of the tax benefits available…

-

Corporation Tax: How To Be Smart And Save Money In 2025

13 May 2025We break down what you need to know about when it comes to Corporation Tax and how to best place your business.

-

Making Tax Digital: Is It Time To Act?

2 May 2025We provide a helpful update of what you need to know about Making Tax Digital in 2025 as a business owner.

-

The Ultimate Tax Guide for Social Media Influencers

10 April 2025Becoming an Influencer can be a lucritive career move but it brings with it a range of tax related challenges. Fear not, our team are here!

-

Personal Tax vs Corporation Tax: Plain and Simple

1 April 2025We provide a plain and simple explaination of the differences between Personal taxes and Corporation tax for you and your business.

-

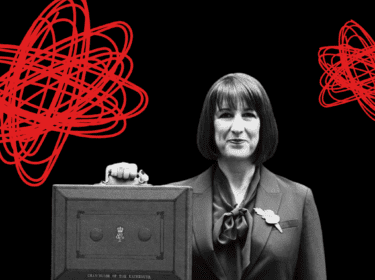

Spring Budget 2025 – What Changed?

28 March 2025On 26th March, the Chancellor, Rachel Reeves, delivered her first Spring Budget amid weak growth forecasts and rising borrowing costs- but for businesses, the headline […]

-

ATED Update – Everything You Need to Know In 2025

18 March 2025With the ATED filing deadline fast approaching on 30th April, here are some top tips from one of our tax specialists, Raj Bassi.

-

Neurodiversity Celebration Week – How We’re Supporting

17 March 2025We look at what we do for Neurodiverse Business Owners and how can help them navigate accounting challenges